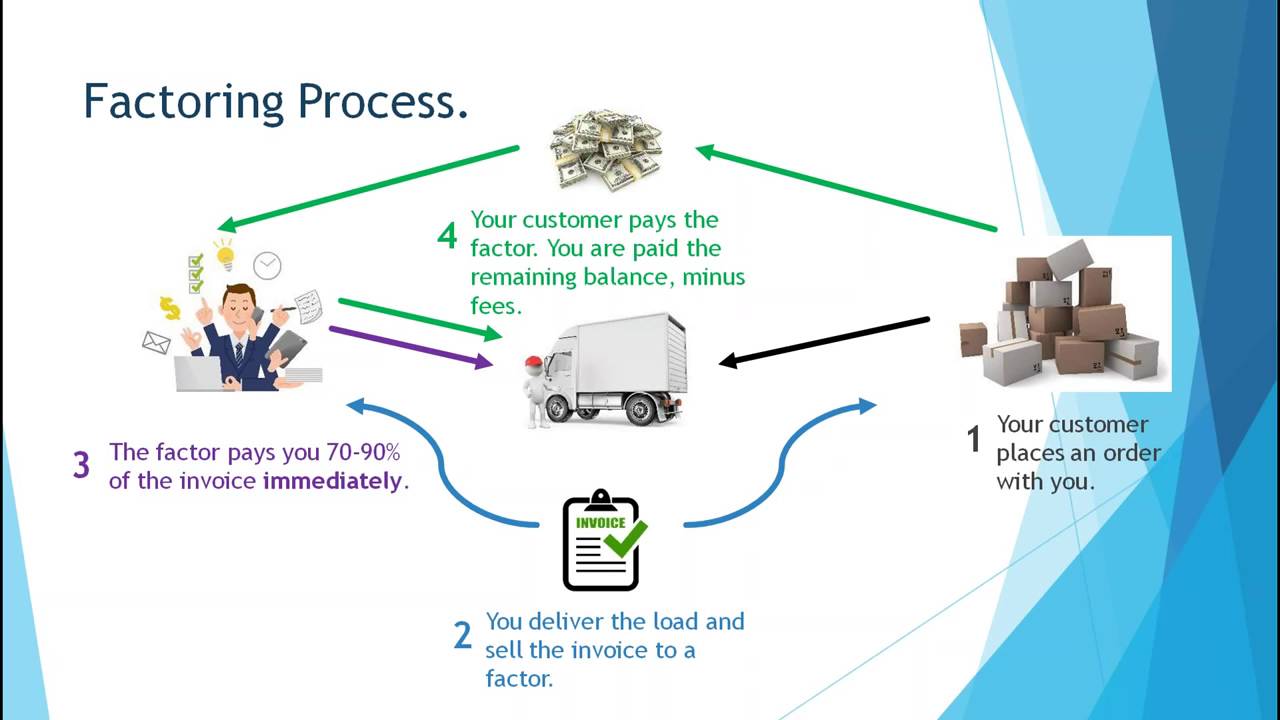

If you factor an invoice amount for £10,000 but your client defaults on the debt, then the factor is unable to collect the money owed. Recourse factoring is a type of invoice factoring facility where you take all the responsibility for any unrecoverable funds. These are the different types of factoring available: Recourse Factoring Take advantage of business opportunities you may come acrossĪllows for cash flow constraints to eased. The use of factoring within your company allows you to release a large part of the tied up cash almost immediately. Clients that have not paid within the 30 days terms could represent a large portion of your revenue, which could be used for cashflow. Some of them may go over your payment terms and require a more chasing on your part. You debtors normally pay within 30 days, some pay pay later and need chasing. When should your Company use Factoring?įactoring should be used by your company when you have lots of outstanding invoices and your cash flow is suffering because of it.Īn example of when you should use factoring is if your organisation sells on 30-day payment terms. Specifically, qualification may depend on the company’s turnover, and requirements will vary from industry to industry. Each factor will have their own set of conditions that determine whether a business is eligible, so the requirements for obtaining a factoring service will vary. Once the outstanding invoice amounts has been collected, the factor will pay you the remaining balance of your money, minus their fee.įactoring only covers business to business transactions.Collection of outstanding invoice amounts with your customers will commence.Once you agree to the terms and conditions, the factor will advance you the money.The invoice factoring company will then assess the credit scores of your clients and will then offer their quote.You submit details of your business invoice to the factor to determine if you are eligible for the factoring facility.A simple process of how does factoring works, is as follows: The remaining amount usually 5-10% when your client settles their invoice, minus any factoring fee.

Most invoice factoring companies in the UK pay in two instalments, the first covering the bulk of the receivables. Lastly, the invoice is the document that shows transactions between a business and its clients. The debtor is the client who owes money to a business in the form of an unpaid invoice. The factor is the financial institution that offers or agrees to buy business debt or unpaid invoices. How Does Factoring Workįor invoice factoring to work there must be a factor, a debtor and an unpaid invoice. Invoice Factoring is available to any business in the UK that trades with other businesses. Account statements to your client and chasing up outstanding payments will also be the responsibility of the lender. The invoice funding factor then administers your sales ledger, taking responsibility for the debts. You will be granted a higher percentage on funds owed to you from a UK blue-chip company than from a sole trader.

#Factoring invoices for dummies plus

The lender will then advance you up to 90% of their value and repays you the remaining amount, minus a commission plus interest on the advance when the accounts are settled. The amount a factor is willing to advance will depend on the standing of the debtor. Invoice Factoring in the UK is where a factor or lender buys all or some of your outstanding invoices. Here is everything you need to know about invoice factoring. UK factoring companies help release cash from your debtor book. Factoring usually includes your own accounts receivable credit control, this is where the lender chases unpaid invoices up on your behalf. Invoice factoring is a way for UK based businesses to raise money by selling invoices owed to your business to a third party factoring company at a discount.

Not only do you get the money you’re owed without the wait, we chase up your outstanding amounts for you with debt collection services. This allows them to get paid sooner, and avoid having to wait until they receive payment from their customer. Instead of waiting for your customers to pay, you borrow against the money you’re owed and is a type of debt financing. Companies use invoice factoring when they need more money than what they currently have available. Invoice Factoring is a method of financing used by companies who sell products or services to other businesses.

0 kommentar(er)

0 kommentar(er)